Singapore's Annual Property Tax (APT) is a significant fiscal component for property owners and investors, managed by the Inland Revenue Authority of Singapore (IRAS). The tax is assessed based on a property's value, use, and location, with progressive rates depending on the property type and value. Owners can claim deductions for mortgage interest, maintenance costs, and rental income to reduce their taxable income. IRAS conducts regular property valuations considering size, type, and market trends to determine APT. Property owners receive a notice of assessment, typically due by January 10th, outlining their tax obligations. Strategic planning around APT can lead to enhanced investment decisions within Singapore's property market, as it directly impacts net returns and cash flow estimations. High-value properties in prime locations face higher taxes, potentially influencing investment choices. However, lower-valued properties offer competitive opportunities for investors. Investors should consider how APT affects their choice between direct ownership and real estate investment trusts (REITs) and explore tax incentives or rebates for optimized portfolio performance. Understanding the APT framework is crucial for navigating the Singapore market effectively, aligning with financial objectives to achieve superior returns. The IRAS's online portal aids in calculating APT, while initiatives like the Provisional Property Tax Scheme offer flexible payment options. Investors should utilize available tax-saving schemes such as the Abandoned Property Tax Rebate and NOR status for non-residents, along with concessions like the Occupier-Pay scheme and renovation rebates to minimize their tax liabilities. Staying informed about policy updates and APT regulations is essential for investors to maximize returns and ensure long-term profitability in Singapore's dynamic property market.

navigating the intricacies of real estate investment in Singapore, understanding the nuances of Annual Property Tax (APT) becomes paramount for both local and foreign investors. This comprehensive guide delves into the multifaceted aspects of APT, its implications on investment returns, and the myriad strategies to optimize this fiscal component. From tax-saving schemes to rebates and incentives, learn how to leverage APT to enhance your property portfolio’s profitability. We explore advanced tax planning, the role of APT in real estate valuation, and the interplay with other taxes like Stamp Duty. With insights into economic policies, interest rate changes, and essential tips for managing your property tax obligations, this article equips you with the knowledge to make informed investment decisions and capitalize on Singapore’s dynamic property tax landscape.

- Understanding the Basics of Annual Property Tax in Singapore

- The Impact of Annual Property Tax on Real Estate Investment

- Strategies for Optimizing Your Property Tax Payments

- The Role of Property Tax in Real Estate Valuation and Appreciation

- Exploiting Tax-Saving Schemes for Property Owners in Singapore

- Leveraging Property Tax Rebates and Incentives

Understanding the Basics of Annual Property Tax in Singapore

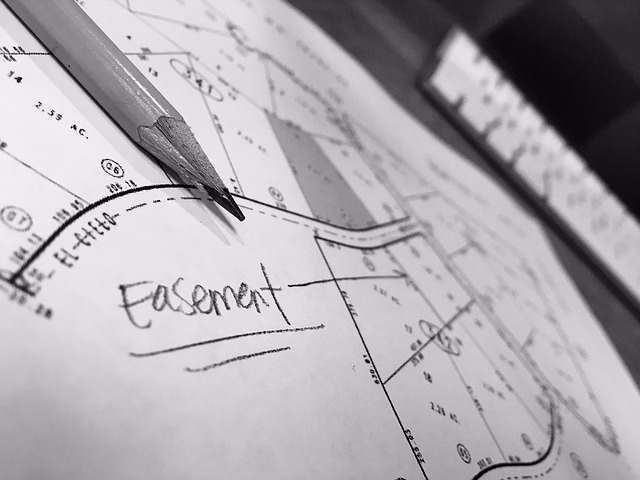

In Singapore, property owners are subject to an Annual Property Tax (APT), which is a key component of the city-state’s tax system. This tax is levied by the Inland Revenue Authority of Singapore (IRAS) and is calculated based on the value of the property, its use, and its location. Understanding the fundamentals of APT is crucial for property owners to manage their financial obligations effectively. The taxable income from property is determined after allowing deductions such as interest on beheading loans, maintenance expenses, and rent received, if applicable. Property taxes in Singapore are progressive, meaning that the rates increase with the value of the property or its classification. For instance, residential properties are taxed at a different rate compared to commercial ones. The valuation of properties for APT purposes is carried out by IRAS and is based on a system that considers both the size and type of the property. Property owners receive an annual notice of assessment from IRAS, which outlines the amount of tax due, typically due by January 10th each year. By familiarizing oneself with the structure, calculation methods, and timelines associated with APT in Singapore, savvy investors can strategize to leverage this financial obligation for profit, potentially optimizing their investment portfolio and capitalizing on market trends.

For those looking to maximize their property investments within Singapore, understanding the nuances of Annual Property Tax is a step towards leveraging this tax effectively. Beyond mere compliance, astute investors can explore various strategies such as timing their payments to align with favorable interest rates or utilizing any potential tax savings to reinvest in their properties. Additionally, staying abreast of changes in tax regulations and property market dynamics allows investors to adapt their investment strategies accordingly, thereby turning the Annual Property Tax into a tool for enhancing profitability rather than viewing it as a mere expense. The Singapore government’s transparency in tax policies provides investors with the opportunity to plan ahead and make informed decisions that align with their financial goals.

The Impact of Annual Property Tax on Real Estate Investment

In the dynamic landscape of real estate investment in Singapore, the Annual Property Tax plays a pivotal role in shaping market dynamics and investor behavior. This tax, levied by the Inland Revenue Authority of Singapore (IRAS), is computed as a percentage of the property’s value and is payable annually. Investors must account for this tax when evaluating potential real estate investments, as it directly impacts net returns and cash flow projections. Notably, properties in prime locations tend to attract higher taxes, which can influence acquisition strategies. Savvy investors use this tax as a metric to assess the potential profitability of properties, considering that lower-valued properties might offer more competitive entry points despite the tax burden. Conversely, high-value properties often command premium prices and rents, allowing investors to absorb the tax while still achieving healthy returns. Understanding the nuances of the Annual Property Tax in Singapore is crucial for real estate investors aiming to navigate the market effectively and leverage tax considerations into profitable investment decisions.

For those looking to maximize their real estate investment yields in Singapore, it’s essential to factor in the various implications of the Annual Property Tax. The tax not only affects ongoing cash flows but also influences property valuations and the overall return on investment (ROI). In a market where capital values have historically appreciated, the tax becomes an integral component of the long-term financial planning for real estate assets. Investors might consider property tax implications when choosing between direct ownership and real estate investment trusts (REITs), as REITs may offer certain tax advantages in this context. Additionally, property tax incentives or rebates for certain categories of properties can provide opportunities for investors to optimize their portfolios and enhance profitability. By strategically leveraging the knowledge of how Annual Property Tax Singapore impacts real estate investments, investors can make informed decisions that align with their financial goals and market conditions.

Strategies for Optimizing Your Property Tax Payments

In Singapore, understanding and optimizing your Annual Property Tax (APT) payments can be a strategic financial move. Homeowners and investors alike can leverage various strategies to manage their tax liabilities effectively. One approach is to take advantage of the different rates applied to various types of properties, such as residential, commercial, or industrial, to structure your property portfolio in a way that minimizes your overall tax burden. For instance, diversifying your property holdings across these categories can lead to more favorable tax treatment on each. Additionally, staying abreast of the Annual Property Tax Singapore framework and its periodic adjustments ensures compliance and uncovers potential savings. The Inland Revenue Authority of Singapore (IRAS) provides an online portal where property owners can calculate their APT based on the value of their properties as assessed annually. Utilizing this tool to monitor your property’s valuation and adjusting your holdings accordingly can be a prudent financial strategy. Furthermore, considering the tax reliefs and rebates available for property owners in Singapore can also significantly reduce your tax payments. For example, the Provisional Property Tax Scheme allows for more manageable quarterly payments instead of annual lump sums, which can alleviate cash flow concerns. By actively managing your property taxes through these strategies, you can enhance the profitability of your real estate investments within the Annual Property Tax Singapore regime.

The Role of Property Tax in Real Estate Valuation and Appreciation

In Singapore, the annual property tax is a key component in assessing the value and potential appreciation of real estate assets. The Inland Revenue Authority of Singapore (IRAS) determines this tax based on the property’s value, which is derived from its annual market value assessment. This valuation plays a pivotal role in informing investors and homeowners about the relative worth of properties within the region. As property values increase over time, often due to factors like economic growth, enhanced infrastructure, or desirability of locations, savvy investors can leverage this data to make informed decisions about purchases, sales, and development projects. Understanding how the tax authorities value properties is crucial for investors to gauge when a property might be under or over-valued, thereby presenting opportunities for capital gains. Conversely, as property taxes contribute significantly to local government revenue, they can also impact market dynamics by influencing buyers’ decisions and sellers’ pricing strategies. Thus, the annual property tax in Singapore is not just a fiscal mechanism but also an indicator of real estate trends and potential profit opportunities for those who closely monitor its implications on property valuation and appreciation.

Exploiting Tax-Saving Schemes for Property Owners in Singapore

In Singapore, property tax is a significant consideration for property owners, but it can also be an opportunity for strategic financial planning. The Annual Property Tax Singapore is not just a liability; it’s a component that savvy investors leverage to their advantage. By understanding and exploiting the tax-saving schemes available, such as the Abandoned Property Tax Rebate and the Not Ordinarily Resident (NOR) scheme, property owners can minimize their tax burdens effectively. These schemes are designed to offer relief to eligible individuals, often reducing the amount of property tax payable. For instance, the NOR status can significantly lower the tax rate for foreign property owners who do not maintain residential ties with Singapore for a specified duration. Additionally, the Inland Revenue Authority of Singapore (IRAS) provides various concessions and incentives that can be tailored to different types of properties and ownership scenarios. For instance, the Occupier-Pay scheme allows for the allocation of property tax payments to the actual occupiers of the property, which can lead to cost savings for owners who rent out their properties. By staying informed about these schemes and adhering to the guidelines set forth by the IRAS, property owners in Singapore can optimize their financial positions and enhance their returns on investment. It’s advisable to consult with tax professionals to navigate these schemes effectively and ensure compliance with local regulations.

Leveraging Property Tax Rebates and Incentives

In Singapore, the Annual Property Tax (APT) is a key component in the real estate market’s ecosystem. Savvy investors and property owners can capitalize on the various rebates and incentives provided by the Inland Revenue Authority of Singapore (IRAS) to reduce their tax liabilities. These tax concessions are designed to promote home ownership, encourage improvements to properties, and support a vibrant and sustainable property market. For instance, first-time property buyers may qualify for the Additional Concessionary Loan (ACL) scheme, which offers lower interest rates on the deferred portion of their loan. Similarly, owners who undertake significant qualifying renovations or alterations to their properties can enjoy a proportionate reduction in their APT for that year. It’s crucial for property owners to stay informed about these rebates and incentives, as they can significantly impact one’s tax obligations and financial planning. The IRAS regularly updates its policies, so keeping abreast of these changes is essential for maximizing the benefits of the Annual Property Tax Singapore system. By doing so, individuals can strategically plan their property investments with a clear understanding of how to leverage tax rebates to enhance their profitability in the long term.