The Annual Property Tax Singapore is a mandatory levy, calculated based on property value, location, and type, funding local government operations, public services, and urban development. Properties are reassessed annually to adapt to market changes. Homeowners and investors must stay informed about assessment processes, payment deadlines, and exemptions to manage their financial obligations effectively. Various financing options, including bank loans, HDB programs, and tax-friendly schemes, help manage the Annual Property Tax. Government schemes offer tax relief, and private lending can provide cost savings. Strategic planning, tracking expenses, and staying updated on regulations are crucial for compliance and financial stability. Understanding deductions and exploring government incentives can further optimize tax obligations.

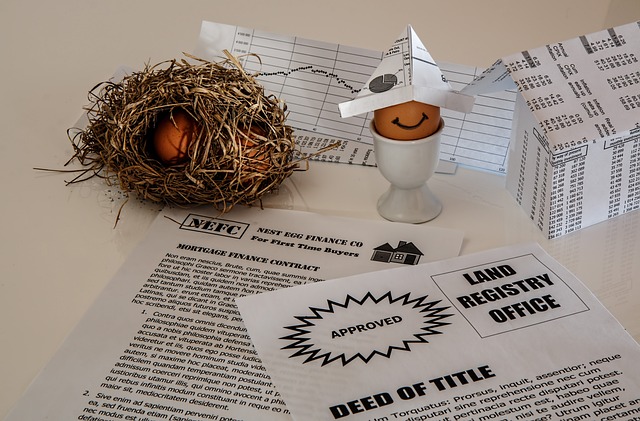

Securing financing for your Annual Property Tax in Singapore can be a complex yet manageable process. This comprehensive guide breaks down everything you need to know, from understanding the tax system and eligibility criteria for exemptions to exploring various financing options and government schemes. We’ll also delve into private lending advantages, financial planning strategies, optimization tips, and common pitfalls to avoid. By the end, you’ll be equipped with the knowledge to navigate Singapore’s Annual Property Tax efficiently.

- Understanding Annual Property Tax in Singapore: A Comprehensive Overview

- Eligibility Criteria for Tax Exemption and Concessions

- Types of Financing Options Available for Property Owners

- Unlocking Government Schemes and Incentives for Tax Relief

- Navigating Private Lending and Its Advantages

- Preparing a Solid Financial Plan for Tax Payments

- Strategies to Optimize Tax Deductions and Savings

- Common Pitfalls to Avoid When Securing Financing

Understanding Annual Property Tax in Singapore: A Comprehensive Overview

Annual Property Tax in Singapore is a mandatory levy imposed on property owners by the government. It’s calculated based on the property’s value, location, and type, reflecting the services and infrastructure provided to that area. Understanding this tax is crucial for property owners as it can significantly impact their financial plans. In Singapore, properties are reassessed annually, ensuring a dynamic tax structure that adapts to market fluctuations.

The tax serves multiple purposes, including funding local government operations, supporting public services like schools, hospitals, and transportation, and contributing to urban development initiatives. Property owners must stay informed about the assessment process, due dates for payment, and available exemptions or deductions to effectively manage their financial obligations. Timely understanding and securing financing for Annual Property Tax Singapore is essential to avoid penalties and maintain a healthy cash flow.

Eligibility Criteria for Tax Exemption and Concessions

Types of Financing Options Available for Property Owners

In Singapore, property owners have several financing options to help them manage their Annual Property Tax. Traditional bank loans remain a popular choice, offering flexible terms and potentially lower interest rates. Homeowners can also explore government-backed schemes like the Housing & Development Board (HDB) loan programs, which are designed specifically for housing-related expenses, including property taxes.

Additionally, some financial institutions provide specialized tax financing options tailored to meet the unique needs of Singapore’s property owners. These alternatives often come with benefits such as tax-efficient interest rates or payment structures spread over the year. With a range of choices available, property owners can strategically select a financing option that aligns best with their financial plans and budget for the Annual Property Tax Singapore.

Unlocking Government Schemes and Incentives for Tax Relief

In Singapore, property owners can access various government schemes designed to provide tax relief for their Annual Property Tax obligations. These initiatives are a testament to the city-state’s commitment to supporting residents and fostering a sustainable housing market. One notable scheme is the Property Tax Rebate Scheme, which offers discounts or refunds based on factors like the type of property and income levels. Additionally, first-time homeowners or those who meet specific criteria can benefit from enhanced relief through programs tailored to promote affordable housing.

Understanding these schemes requires some research, but it’s a worthwhile endeavor for property owners in Singapore. The government regularly updates its policies, so staying informed ensures that you don’t miss out on potential savings. By availing themselves of these incentives, homeowners can alleviate the financial burden of Annual Property Tax Singapore and potentially free up funds for other essential expenses or investments.

Navigating Private Lending and Its Advantages

In Singapore, navigating private lending options can be a strategic move for individuals and businesses looking to secure financing for their Annual Property Tax obligations. This alternative funding route offers several advantages when it comes to property tax payments, especially in a dynamic market like Singapore. Private lenders provide access to flexible loans tailored to meet the specific needs of property owners, allowing them to manage cash flow effectively during peak tax seasons.

One significant benefit is the potential for lower interest rates compared to traditional banking options. Private lending platforms often cater to a diverse range of borrowers, enabling them to offer competitive terms. This can result in substantial savings for property taxpayers in Singapore, making it an attractive solution to fund annual property taxes efficiently and cost-effectively.

Preparing a Solid Financial Plan for Tax Payments

Preparing a robust financial plan is key when it comes to managing your Annual Property Tax Singapore obligations. This involves assessing your current financial situation, setting realistic goals, and creating a budget that accounts for tax payments. Start by evaluating your income sources, fixed expenses, and variable costs. Understand how much you can allocate towards property taxes without compromising other essential expenditures. A well-structured budget will ensure you have the funds readily available when tax payment dates approach, avoiding late fees or penalties.

Consider using financial tools to track your expenses and set up reminders for tax payments. This proactive approach enables you to stay on top of your fiscal responsibilities, ensuring compliance with Singapore’s property tax regulations. By preparing a solid financial plan, you can effectively manage your Annual Property Tax Singapore obligations, promoting financial stability and peace of mind throughout the year.

Strategies to Optimize Tax Deductions and Savings

Optimizing tax deductions is a key strategy for reducing your Annual Property Tax Singapore burden. One effective approach involves keeping detailed records of all expenses related to your property, including maintenance, repairs, and improvements. By meticulously documenting these costs, you can accurately claim deductions that lower your taxable income. Additionally, exploring potential incentives and grants offered by the government specifically for property owners can significantly enhance savings.

Another valuable tactic is to stay informed about recent changes in tax laws and regulations. Singapore’s tax landscape evolves, offering new opportunities for optimization. Regularly reviewing these updates allows you to take advantage of any changes that could benefit your property investment. Efficient tax planning requires proactive measures, ensuring every legitimate deduction is considered to minimize the Annual Property Tax Singapore liability.

Common Pitfalls to Avoid When Securing Financing